Each taxpayer must pay taxes on time. If you do not meet the allotted time, a citizen can be held accountable. But which one? What will happen if you do not pay transport tax in Russia? Is it possible to somehow not transfer money to this accrual account at all? And how is it proposed to conduct such transactions? The answers to all these questions and not only need to know every person. Especially for those who own motor vehicles.

What they pay for, or tax characteristics

Before finding answers to the questions asked, everyone should understand what he will deal with. What is a transport tax?

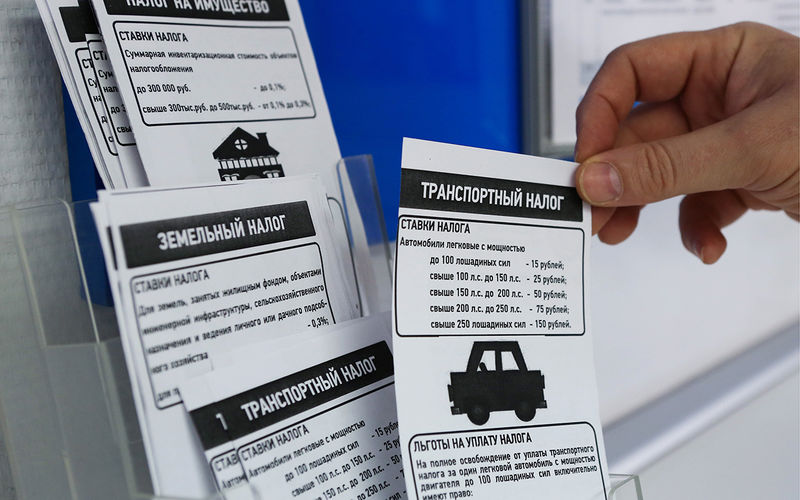

This is the name of the annual tax charged to citizens-owners of movable property with a motor. There are exceptions, but there are not as many as we would like. Transport tax rates are determined by each region independently. And the benefits for this charge - too.

Time of payment. Information for individuals

It is also worth paying attention to what date it is necessary to transfer funds to the tax authority. The delay does not begin immediately, taxpayers are given a lot of time for voluntary payment of tax.

At the moment, the timing of payment of tax on cars from individuals and legal entities will be different. Let's start with the first category of population.

Citizens must pay a car tax by December 1. This deadline is valid in 2019. With all this, the funds will go to the state treasury for finding property in the property last year.

To what date to pay - data for legal entities

Transport tax for the year will need to be paid not only to citizens, but also to organizations. Only for this category of taxpayers there are slightly different terms for transferring funds to the state treasury.

Organizations, entrepreneurs, and legal entities must pay the car tax by February 5th. They are exempted from advance payments.

The main consequence of the delay

What will happen if you do not pay transport tax? The thing is that a definite answer will not work. It all depends on the specific situation, as well as on the amount of debt. Therefore, all existing consequences of non-payment of tax on the car will be considered below.

From the first day of delay (from the second of January or from the sixth of February, respectively), the payer will be additionally punished. The fight begins with the debtors accruing interest. Its size is calculated according to the following formula: tax amount * interest rate of the Central Bank * 1/300 * number of days of delay.

This accrual is carried out daily. This means that the longer a citizen does not pay, the more money he will have to transfer to the state treasury in the end.

Additional fine

What will happen if you do not pay transport tax? As already mentioned, it all depends on the particular case. But the penalty will still be charged. This can only be avoided by timely payment of money to the state treasury.

If a citizen has overdue tax, he may be fined. It makes up 20 percent of the accumulated debt. Accordingly, in this case, you will have to pay a fine, a tax, and a penalty.

Such a sanction is applied, as a rule, when the tax authority cannot prove intentional tax evasion. But what about those who do not specifically pay bills?

Increased Penalty for Dodgers

Transport tax debtors in Russia are held liable. They try to punish them in every way so that the next time taxpayers fulfill their obligations on time.

If a person intentionally does not pay taxes, he will face an increased fine. In this case, it will be 40 percent of the accumulated debt. But that is not all! Debtor defaulters can significantly complicate their lives by their actions. But how?

Seizure of property

Penalties and fines on the transport tax are not the only means of dealing with defaulters. The thing is that in the Russian Federation, under certain circumstances, additional sanctions are applied. How are they expressed?

For example, seizure of property of a citizen. Usually such a measure takes place if the amount of the debt reaches 3,000 rubles. It is in this case that an application may be filed with the court with a request to seize the property of the debtor.

Important: if the debts to the Federal Tax Service are too high, the property can be sold, and the proceeds sent to repay the debt. The rest of the money, if any, will be transferred to the former debtor.

If you have a bank card or account

I wonder what will happen if you do not pay the transport tax? There are several more punishments for defaulters. This is especially true for those who deliberately do not pay bills.

In addition to the seizure of the debtor’s property, bank accounts and cards may also be blocked. Previously, bailiffs could write off money from taxpayers' “plastic” as a debt, but now this measure is prohibited. In any case, it will be considered illegal.

Problems for travelers

Interested in transport tax? The procedure and timing for the payment of this payment must be known to everyone. And about the consequences of the resulting delay, too. Sometimes they can seriously ruin the life of a citizen.

In addition to the sanctions listed above, a non-payer may be prohibited from leaving the country. Departure within the Russian Federation will be allowed, but traveling abroad will have to be postponed.

A similar measure is used by bailiffs. The restriction is removed after the taxpayer settles all his debts.

No payment - there is a responsibility

The notification of the payment of transport tax to this day is considered the main payment document. In it you can see the data about the recipient, as well as about the payer and the amount of tax charges. Very comfortably!

Everyone should remember that the absence of a tax notice is not a basis for tax evasion. Ignorance is not an excuse. Therefore, citizens should be independently worried about checking taxes and their timely payment.

Important: transport tax notifications should be sent out by November 1st.

Data Validation Methods

How and where to pay the transport tax? Today, almost all methods of checking tax debts allow you to immediately pay them off. But there are services designed exclusively for checking or paying taxes.

I wonder if a person has a tax on cars? Then you can use the following methods of checking such data:

- create an application for "State services";

- use the website of the Federal Tax Service (personal account of the taxpayer);

- work with an online wallet;

- use third-party debt verification services;

- check data through the website "Payment of public services";

- scan the FSSP database on the Internet.

In addition, it is proposed to find out about taxes and debts on them through authorized bodies - from bailiffs or employees of the Federal Tax Service.

Important: tax notifications also indicate the information required by the citizen.

Payment Methods

What will be the delay in payment of the transport tax? Penalties and fines threaten an inattentive or irresponsible citizen or organization. How can I pay tax?

Firstly, all the verification methods listed above will be suitable, except for contacting authorized services. Additionally, it is proposed to deposit money into tax accounts:

- using online banking;

- through the cash desk of a financial company;

- payment terminals;

- ATMs.

Everyone decides which option to use. In practice, taxes and penalties are increasingly paid online. Some of the proposed solutions charge a transaction fee.

About Prescription

The vehicle tax rate helps you calculate the amount of vehicle tax. It is hard to believe, but this payment may not be made under certain circumstances. Say, if you wait for the end of his statute of limitations.

He is 3 years old. After this time, the tax and debt on it burn. So, you don’t have to pay.

The countdown starts from the very beginning if the state was able to detect the debtor's place of residence or some of his property. In modern realities, waiting for the tax to be burned is more difficult than it seems.

No tax for

As already mentioned, there is no need to pay tax for some vehicles. It is worth paying attention to the federal standards established by the state for all regions.

So, vehicle tax is not charged for:

- vehicles without a motor;

- boats on oars;

- auto special services;

- state cars;

- agricultural transport;

- a car used by people with disabilities (specially equipped for this);

- A vehicle purchased with social support if the engine power does not exceed one hundred “horses”;

- boats with an engine up to 5 hp;

- passenger and cargo ships, if used for their intended purpose.

Other benefits must be found in a specific region. Only in this way will it be possible to achieve the desired result, and also not to gain a lot of problems due to overdue taxes.

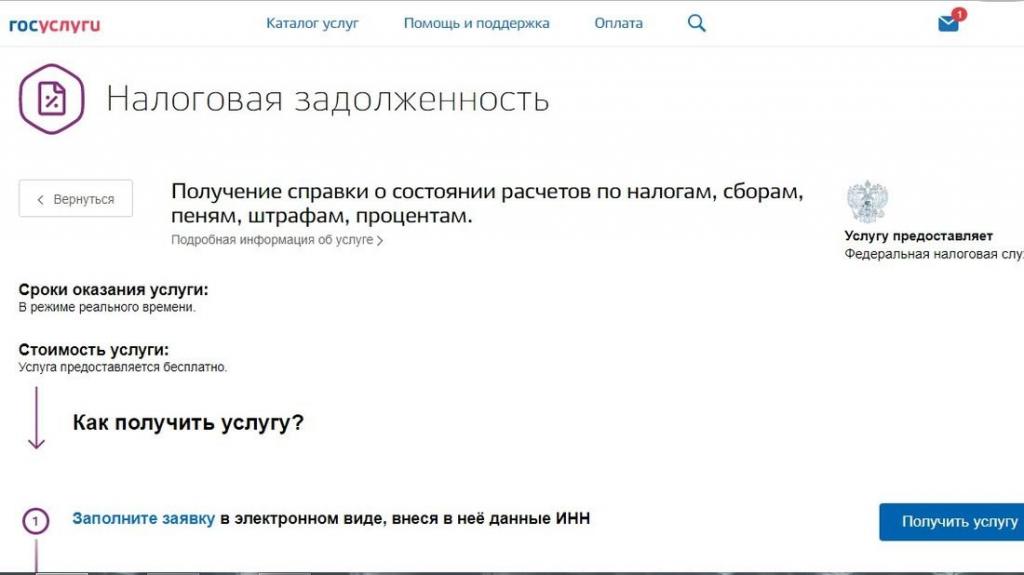

Example of checking and paying tax

Some citizens have serious problems finding and paying fines / taxes online. Let's consider similar operations on the example of work with "State services". For the successful implementation of the task, you will first have to register for the service, and then verify your identity. Without this, achieving the desired result would not be possible.

We assume that the profile at ESIA is fully prepared for further operations. Then the user will need:

- Go to the archive of available options.

- Find the service "Check your taxes."

- Indicate the TIN of the potential debtor.

- Click on the button responsible for starting the database scan.

- Choose a particular payment. Auto tax will be signed accordingly.

- Click on the "Go to payment" button.

- Decide on the method of paying tax, and then fill in the payment details.

- Confirm charge.

Fast, easy and very convenient! Transactions through government services are not subject to commission.

Important: it is recommended to pay the main tax first, and then debts on it, as well as accrued fines. This will help to avoid additional penalties.