Is it easy to lose your fortune? Some billionaires become bankrupt due to one unsuccessful decision, while others due to various circumstances over a period of time.

The reasons for financial ruin can be different: economic downturns, bad investments or even fraud. This article gives examples of those who went bankrupt, having lost their very huge fortune due to various circumstances.

Patricia Kluge

In 1981, Patricia married television magnate John Kluge. At one time, a man’s fortune was estimated at about five billion dollars. Nine years later, the couple divorced. The woman seized a huge estate and one billion pounds from her ex-husband.

Patricia Kluge invested most of the money in her winery. But because of the economic crisis, wine production stalled: a woman had to auction jewelry and works of art. However, without success - in June 2011 Kluge had to officially declare bankruptcy.

Vijay Mallya

The Indian billionaire and owner of the Force India team in Formula 1 racing has lost most of their fortune, being unable to repay bank loans. In India, they are still seeking his extradition for breaking the law, because he is hiding from the authorities in the UK.

Vijay was known for his extravagant lifestyle: he owned one of the most expensive yachts in the world, he had noisy parties and owned the Indian airline Kingfischer Airlines. But due to non-payment of debts and loans, Mallia is accused of bank fraud and money laundering, estimated at about 1.1 billion euros.

Sean Quinn

The billionaire was once one of the richest people in Ireland. However, banking problems affected: after a huge loan at an Anglo-Irish bank, Quinn had to give up most of her $ 2.8 billion. It became clear that it was no longer possible to regain his condition. In November 2011, Sean announced that his net assets were less than £ 50,000. He soon filed for bankruptcy.

Jocelyn Wildenstein

In the vicinity of New York, Jocelyn Wildenstein was called the woman lioness and bride of Frankenstein because of her extraordinary appearance. There was a time when she spent more than 1 million dollars a month - 5,000 "green" went only to the expense of telephone communications. Despite the $ 2.5 billion she received as a result of her divorce from art dealer Alec Wildenstein, by 2018, she had declared herself bankrupt. She spent most of the money on plastic surgeries, expensive items, jewelry and other vagaries.

Bernard Madoff

Before the legal scandal in 2008, the net assets of Bernard and his wife were approximately $ 800 million. Once this entrepreneur inspired confidence, however, as they say, all the secret becomes apparent.

Bernie, as his relatives called him, was accused of creating perhaps the most gigantic financial pyramid: investor losses totaled $ 65 billion! Bernard Madoff pleaded guilty to fraud, money laundering and perjury. He received a maximum sentence of 150 (!) Years in prison.

Elizabeth Holmes

Once the girl’s net worth was about $ 5 billion. Her Theranos blood test company was valued at 9 billion green in 2015. Elizabeth claimed that she needed only a few drops of the patient’s blood to determine the analysis. Having reported a breakthrough in this area, Holmes attracted multimillion-dollar investments and several medical networks began to conclude contracts with Elizabeth.

However, it soon became clear that the blood tests were very inaccurate. Holmes was accused of fraud (in fact, misleading people with "revolutionary treatment") in June 2018 and currently does not have any impressive capital. After such accusations, Theranos ceased to operate.

Bjergolf Gudmundsson

The Icelandic tycoon Bjergolf Gudmundsson became rich thanks to the brewing industry. Nevertheless, one of the richest people in Iceland was supposed to declare bankruptcy in 2009. His petition for bankruptcy included huge debts of $ 759 million. At that time, it was the largest bankruptcy petition in Icelandic history.

The main reason for the fall of Gudmundsson was the collapse of the Icelandic economy market. He and his son were the main shareholders of the Icelandic bank Landsbanki, which went bankrupt in 2008.

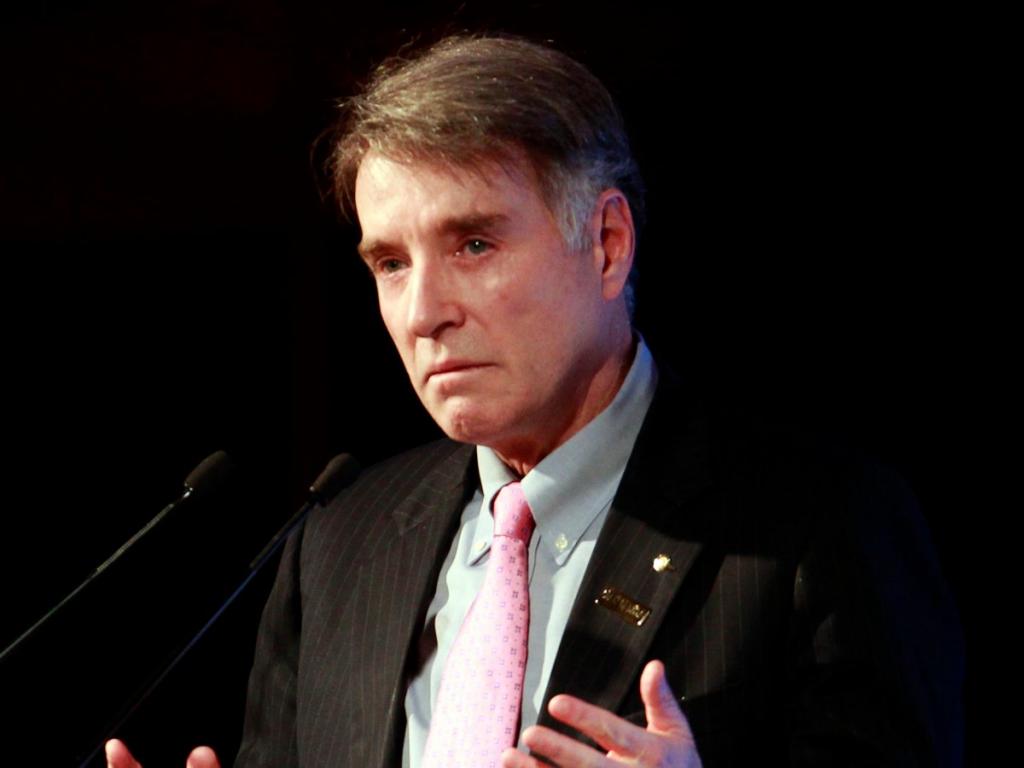

Eike Batista (in the photo at the top of the article)

According to the popular Forbes magazine, Eike Batista was in seventh place in the list of the richest people in the world in 2012. How did he manage to achieve such a success? Thanks to the sale of oil. He owned the oil company OGX, and his net worth was estimated at $ 30 billion. Unfortunately, OGX went bankrupt in 2013, and Batista lost most of her assets.

In January 2017, Batista was charged with money laundering and corruption, and after a year and a half he was sentenced to 30 years in prison for bribing former Rio de Janeiro governor Sergio Cabral.

Robert Allen Stanford

The life path of the next hero of our article is similar to that of the already mentioned Bernard Madoff. It is said that Stanford created the second largest (after Madoff, by the way) financial pyramid in US history. Investor losses amounted to seven billion dollars.

Stanford had over 18,000 customers. Unlike the victims of Madoff, many of Stanford's former clients still have not received any compensation payments. Allen promised many retirees "safe investments", earning on their trust.

After the Securities and Exchange Commission in February 2009 stormed the headquarters of his company, Stanford was accused of "massive and constant fraud." He was later convicted of 13 deaths and is currently serving a 110-year sentence in a Florida maximum security prison. However, the consequences of the crimes are still felt: his victims are still suffering the loss of tens of millions of dollars.

Donald Trump

You may be wondering why the current president of the United States of America is also on our list of failed billionaires.Yes, even Donald Trump has a sad experience of bankruptcy. Although he never had to plead bankrupt, the former entrepreneur and current politician announced the closure of some of his establishments.

The entertainment complex of Trump's Taj Mahal (built for one billion dollars) in Atlantic City over time began to bring only one loss. The property was liquidated and sold out in 2017, as payments to shareholders could no longer be guaranteed due to low financial condition. Two other Trump casinos and his New York Plaza hotel went bankrupt for similar reasons.

Interestingly, in the framework of the 2016 presidential debate, Donald Trump was even asked the question: "How can you be trusted with the American economy, given such bankruptcies?"

Conclusion

So, this article told us about ten billionaires, each of whom, due to various circumstances, suffered serious losses. Moreover, some of them were accused of fraud, and someone even served a huge term for financial fraud.

Let this information prompt us not to envy the rich: you never know what tricks they can go to advance their capital.